Imagine this: you open your bank app and find a $2,000 “tariff dividend” sitting in your account. It sounds like a twist in an economic thriller, but President Trump says it could become reality. Read on to uncover how this unexpected payout could happen—and why it might affect you.

What It Is: The Tariff Dividend Explained

President Trump has announced a bold initiative: a tariff-derived dividend of ‘at least’ $2,000 per eligible American, funded by revenues from tariffs on imports. He proclaimed the payout would exclude high-income individuals and said the remainder of tariff income would help reduce national debt.

The key phrase: “at least $2,000 a person (not including high income people!)”. While the details remain fuzzy, the promise has stirred anticipation across households.

Background: How This Dividend Came About

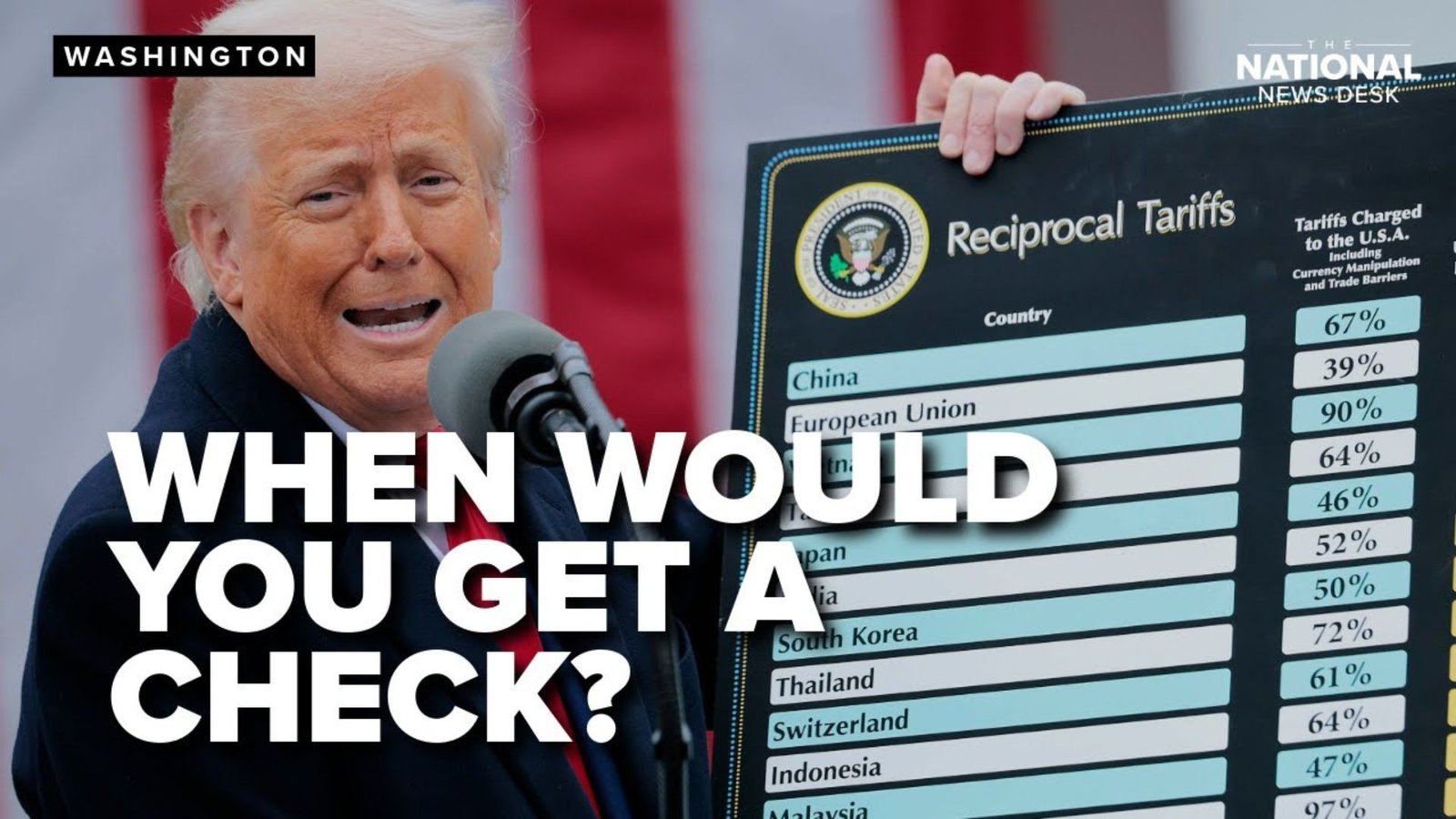

This isn’t a spontaneous idea—it follows a major shift in trade policy and tariff revenue. The Trump administration has imposed sweeping tariffs under its “reciprocal tariffs” strategy, generating significant earnings for the federal government.

Economists estimate the cost of a $2,000 dividend for most Americans could run into hundreds of billions of dollars—raising questions about funding and feasibility.

Why It Matters Today

For households feeling squeezed by inflation and rising costs, the idea of a direct cash payout is electrifying. If implemented, the dividend could offer real relief to middle-income and lower-income Americans, while also signaling a shift in how trade policy translates into personal benefit.

At the same time, experts warn about economic risks: using tariff revenue for payouts could be difficult, and the plan still faces legal, legislative, and logistical hurdles.

How You Could Benefit (and What to Watch)

- Eligibility criteria are still emerging—but so far the President says high-income earners will be excluded, hinting at a cutoff (e.g., families under $100,000) being discussed.

- Timing: No official payout date has been confirmed yet. Some estimates suggest early 2026 if the plan moves ahead.

- What you can do now: Monitor announcements, ensure your bank information is up-to-date, and stay alert for eligibility registration or automatic crediting.

| Benefit | Implication for Households |

|---|---|

| $2,000 minimum payout | Immediate boost to income or savings |

| Tariff revenue source | Ties personal benefit to trade policy |

| Exclusion of high-income earners | Focus on middle and lower-income groups |

| Risk/Challenge | What to consider |

|---|---|

| Legislative approval required | Congress must sign off; plan is not yet guaranteed |

| Funding constraints | Tariff revenue may not cover full cost |

| Legal hurdles | Tariffs used to fund payout face potential court challenges |

Notable Facts You Should Know

- President Trump made the pledge via social media, stating: “A dividend of at least $2,000 a person (not including high income people!) will be paid to everyone.”

- Analysts estimate a $2,000 per person payment for eligible Americans could cost $300 billion or more each year.

- Treasury officials have hinted the payout may be targeted (for example, to those earning under $100,000) rather than universal.

Expert Tips & Insights

- Treat the announcement as a pre-announcement, not a guarantee. Plans may change.

- Keep your financial information current—if the payout is automatic, you’ll want no delays.

- Understand how your income or account status might affect your eligibility; high-income exclusion is likely.

- Be wary of scams: promises of payouts often attract fraudulent claims. Official channels will provide instructions.

- Consider how the dividend might impact your tax planning—or how it may affect savings or debt reduction.

Frequently Asked Questions

Q: Will everyone get the $2,000?

A: No—so far the plan targets most Americans excluding high-income individuals, though exact income thresholds are not finalized.

Q: When will the money arrive?

A: There’s no fixed date yet. Payments (if approved) may begin in 2026, after legislation is secured and administrative details are set.

Q: Is the payout guaranteed?

A: Not yet. The plan requires congressional approval, funding mechanisms, and possibly legal clearance.

Q: Will this count as taxable income?

A: That depends on how it is structured—cash payments or credits could differ in tax treatment. Stay tuned for official guidance.

Conclusion: The Big Disclosure and Your Next Move

Here’s the final twist: the promise of a $2,000 tariff dividend isn’t just political spin—it could be your next bank deposit. But only if the plan moves through Congress, aligns with trade revenue, and clears legal hurdles. While it holds real promise for millions, it also demands caution and vigilance. Stay informed, keep your details ready, and when the payout window opens, you’ll be poised to claim your share. The message is clear: this isn’t a future scenario—it might be your present opportunity.